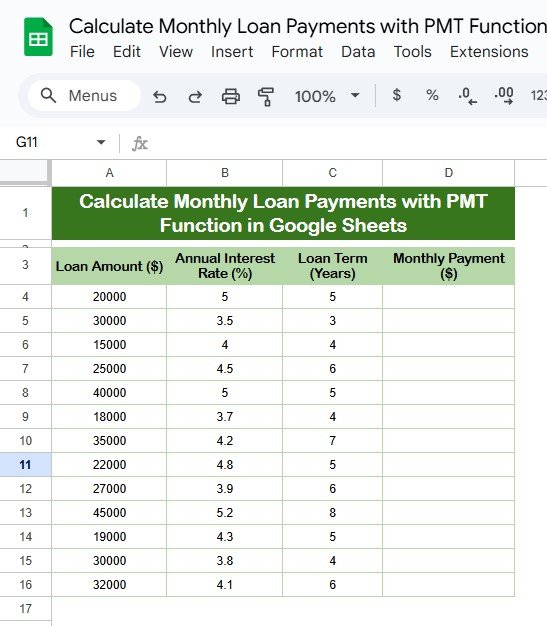

What Does PMT Mean in Finance? Decoding the Key Term Behind Monthly Payments

What Does PMT Mean in Finance? Decoding the Key Term Behind Monthly Payments

In the world of personal and corporate finance, few abbreviations carry as much weight as PMT. Standing for "Payment," this simple term underpins countless transactions—from mortgage loans and auto loans to credit card statements—serving as a cornerstone in understanding cash flow, debt obligations, and financial planning. While commonly used across lending, leasing, and installment agreements, the precise meaning of PMT depends on context, contractual terms, and financial structure.

This article unpacks what PMT truly means in finance, how it operates across key instruments, and why comprehending this metric is essential for informed decision-making.

At its core, PMT refers to the amount paid periodically to settle a financial liability—most often in the form of loan repayment, lease installments, or credit card dues. The payment represents a negotiated obligation between a borrower and a creditor, locked into a fixed schedule defined by interest and principal components.

But the mechanics behind each PMT can vary significantly depending on the instrument, influenced by interest rates, amortization schedules, and deposit structures.

The Technical Breakdown: How PMT Functions Across Financial Products

While PMT describes periodic payment, its calculation is deeply rooted in mathematical models of interest and amortization. Whether in amortizing loans or straight-line leases, PMTs reflect a balance between repaying borrowed principal and covering time-value-of-money charges. Understanding this breakdown enhances transparency in financial agreements.

Amortized Loans: The Dominant Framework Most commonly, PMT applies to amortized loans—structured so that each payment reduces principal while covering interest accrued over the remaining term.

The payment amount is calculated using a fixed formula based on the loan principal, annual interest rate, and term. For example, in a 30-year fixed mortgage at 4% interest, a $300,000 loan generates monthly PMTs averaging approximately $1,234. Over time, early payments allocate more to interest; later payments channel more toward principal.

Operational Rules: Principal vs.

Interest Split Each period, a portion of the PMT reduces the outstanding principal, while the remainder covers interest based on the remaining balance. This dynamic varies by loan type:

- Fixed-rate mortgages: Interest remains stable; principal grows steadily across equal installments.

- Credit card PMTs: Interest accrues daily and is applied primarily to the outstanding balance, with minimal principal reduction unless interest-free periods end.

- Car loans with interest-only phases: Payments may shift focus from interest to principal after initial terms, altering the repayment rhythm.

Regardless of structure, the total payment remains a fixed figure agreed upon at contract inception, offering predictability but requiring careful scrutiny of long-term total cost.

Real-World Applications: When and Why PMT Matters

PMT is not merely an accounting footnote—it’s a practical gauge used by lenders, borrowers, and financial advisors to manage risk and plan for the future. Its role extends beyond monthly bookkeeping into strategic financial health assessments.

Monthly Cash Flow Management: For homeowners, car buyers, or student loan borrowers, PMT determines how much of monthly income must be allocated to debt service.

During economic downturns or income disruptions, overestimating PMT capacity can lead to payment defaults—making precise PMT modeling vital.

Loan Comparison and Budgeting: Financial institutions and consumers alike use PMT to compare loan offers. A mortgage with a 3.5% rate over 30 years may boast a lower PMT than a 4% loan over 15 years, but total interest paid differs significantly. Ptolemy’s Law—“All payments are interest plus principal”—remains critical: a shorter term increases PMT but slashes long-term cost.

This trade-off underscores why PMT analysis enables informed borrowing.

Credit Scores and Financial Reputation: Timely PMT payments directly boost credit scores by demonstrating responsible credit use. Conversely, missed or scaled PMTs trigger credit line reductions, higher interest rates, and long-term financial damage. In this way, PMT is both a measure of debt and a builder of credit equity.

Navigating Complexity: Factors Influencing PMT Variability

While PMT follows formulaic principles, real-world deviations arise from contract terms and external factors.

Recognizing these nuances prevents financial missteps and supports proactive management.

Interest Rate Types and Compounding Frequencies: Whether interest compounds annually, quarterly, or daily affects the periodic payment. Credit cards typically compound daily, meaning each PMT captures a larger interest portion early. Fixed-rate products, however, lock the rate, preventing such shifts—though locked-in rates may carry higher initial PMTs than variable options.

Related Post

Unveiling The Mystery: What Does the Fox Say? The Truth Behind One of Nature’s Most Enigmatic Sounds

What Year Defines the Twentieth Century? Unlocking the Century’s Exact Boundary

Dale Brisby Wiki: Unveiling the Enigmatic Legacy of an Aviation Pioneer

Crafting Full Netherite Armor: A Precision Step-by-Step Guide for Endgame Survivors