When Does Cash App Direct Deposit Hit? The Inside Timing Behind Instant Money Transfers

When Does Cash App Direct Deposit Hit? The Inside Timing Behind Instant Money Transfers

Cash App users rely on speed and accuracy when receiving direct deposits, but the precise moment money lands in your account hinges on a complex interplay of bank schedules, transaction timing, and user setup. Unlike traditional payroll deposits processed mid-week, Cash App’s direct deposit functionality offers instant transfers—often within minutes—but the exact timing of when funds appear varies due to banking infrastructure and user actions. Both employers and users must understand the mechanics to anticipate when money hits the bank account.

At the heart of Cash App’s direct deposit system is the rapid transfer of funds via the network’s connection to financial institutions, but “instant” does not mean arbitrary. Normally, direct deposits scheduled for a specific pay period—such as Friday 5 PM or the first of the month—follow a predictable path. Yet when the deposit trigger aligns with a business’s payroll cycle, cash arrives far quicker, sometimes within seconds or a few minutes of the cutoff time.

“Cash App uses real-time payment rails through The Clearing House’s RTP network, enabling near-instant settlements when conditions are met,” explains Sarah Lin, a fintech analyst at Financial Pulse. “But speed depends on both the initiator’s schedule and the receiving bank’s processing window.”

Employers play a pivotal role: when a company schedules direct deposits for payday, Cash App’s deposit hit time is typically semifinalized to within minutes post-cutoff. However, deviations occur.

If funding occurs just ahead of a payroll date—say, Thursday at 3:59 PM—the transfer may clear by end-of-day, arriving as early as 5 PM or by the next business hour. Delayed processing, weekend processing, or morning deposits from subsequent months can all shift the timeline. Notably, Cash App’s integration with primary financial institutions determines whether the transaction waits for business day processing or hits the account immediately via instant payment channels.

User conditions shape deposit timing just as much. Deposits initiated just before the pay period closes—often 30 or 60 days prior—follow established payroll workflows, where banks routinely clear funds by the end of standard business hours. But cash arriving via Cash App’s “instant” option usually bypasses standard bank holidays and weekend processing, relying instead on real-time payment networks.

“If you set up direct deposit for your Cash App account but fund it exactly at the 5:00 PM cutoff, the deposit is nearly guaranteed to appear in your balance by 5:30 PM or earlier,” says Lin. “That speed differentiates Cash App from legacy systems that delay disbursement until the end of the workweek.”

Several key factors determine exactly when funds appear:

- Employer Schedule: Payroll cycles—weekly, biweekly, monthly—set the baseline timeline. Cash App deposits aligned with cutoffs execute faster.

- Deposit Timing: Submitting payment just minutes before payroll closes ensures faster routing.

- Cash App Instant Transfer: When activated, funds travel through RTP or similar networks, offering near-immediate settlement.

- Bank Processing Windows: Despite instant positioning, local banks may batch transaction processing, introducing small delays.

- Weekend or Holiday Cutoffs: Deposit processing often pauses over weekends; Monday morning remains the fastest typical arrival window.

To illustrate, consider a weekly payroll scheduled every Friday at 4:30 PM.

When an employer configures direct deposit with Cash App on Thursday afternoon, the deposit typically clears by 5:30 PM, already available in the account the same day. Should the deposit be triggered at cutoff, next-day deposits—say, Friday at 9 AM—may see funds arrive early in the business day following weekend clearing. Conversely, if a deposit is processed on a Saturday or Monday morning cutoff, full settlement may take until the next business day.

For freelance or irregular income—such as gig work payments—timing fluctuates based on when the payout is initiated relative to the bank’s processing cycle.

Real-world examples reinforce these patterns. During Cash App’s annual surge in May and October payroll rushes—when millions deposit wages simultaneously—transaction volume spikes across banking networks, but institutional speed wrecks delay.

Users report funds hitting accounts within 10

Related Post

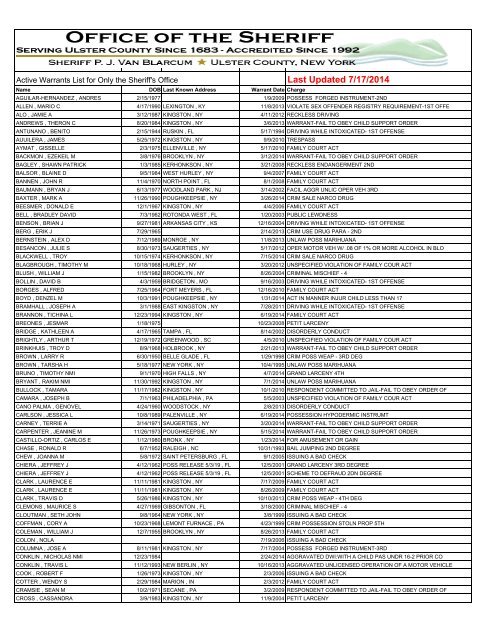

Ready to See New Active Warrants from Rome, NY — Ulster County Sheriff’s Department Just Expanded Hold List

Renew Car Registration in Ny: A Simple Guide to Smooth Registration and Compliance

Where Does Roger Federer Live: The Refined Man in His Sentimental Swiss Sanctuary

Patricia Heaton Movies And Tv Shows A Comprehensive Guide