Who Dares to Outpace Akamai? The Growing Threat to the CDN Dominance

Who Dares to Outpace Akamai? The Growing Threat to the CDN Dominance

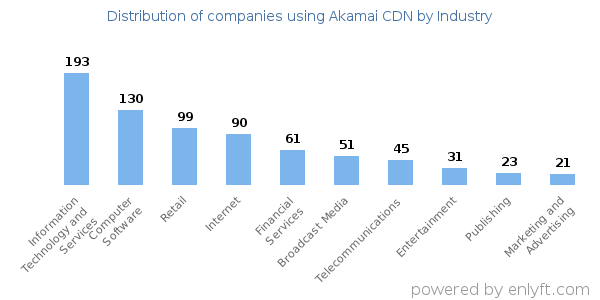

In a digital battlefield where latency, security, and scalability define competitiveness, Akamai has long reigned as the undisputed CDN titan—powering 30% of the global internet, from streaming giants to Fortune 500 enterprises. But a rising tide of challengers, fueled by hyperscalers, open-source innovation, and specialized niche players, is shaking the foundation of this long-standing monopoly. These competitors exploit new architectures, vendor lock-in fatigue, and diverse performance demands, redefining what a modern Content Delivery Network must deliver.

The CDNs of tomorrow are no longer just about speed—they’re about adaptability, security, and seamless global integration. Akamai’s legacy is built on reliability and scale, but today’s digital landscape demands more than just infrastructure—it requires agility, cost-efficiency, and developer-friendly tooling. Enter a new wave of competitors attacking Akamai’s dominance from multiple fronts: hyperscale cloud providers leverage their ubiquitous data center footprints to offer built-in CDN services; open-source projects democratize delivery with engines like配信 (deliverd) and Terminus; and agile layer-2 CDNs target edge performance with lightweight, API-driven solutions.

The result is a fragmentation of market share, driven by innovation that challenges Akamai’s traditional billing models, deployment complexity, and rigidity.

The Hyperscale Onslaught: Cloud Giants Enter the CDN Arena

Amazon Web Services (AWS) CloudFront remains Akamai’s most formidable traditional rival, utilizing its 3-node global backbone and tight integration with AWS services to deliver low-latency performance at scale. Yet AWS has expanded beyond pure infrastructure, embedding intelligent routing, managed security, and real-time analytics—features Akamai once controlled exclusively.CloudFront’s pay-as-you-use pricing appeals to cost-sensitive customers, but its proprietary ecosystem can still lock users into long-term commitments. Microsoft Azure by contrast positions CDN services through its Azure CDN, tightly aligned with Microsoft’s enterprise stack. It excels in hybrid cloud environments, making it a preferred choice for organizations already invested in Windows infrastructure or Microsoft 365 ecosystems.

Azure CDN’s integration with Azure Active Directory and consistent SLAs across regions provide compelling value—particularly for corporate clients prioritizing governance and compliance. While not always the fastest per se, Azure’s seamless orchestration with other Azure services strengthens its appeal in enterprise environments. AWS and Azure exemplify how cloud hyperscalers leveraged their global network presence and software ecosystems to deliver CDN capabilities natively—no separate subscription needed beyond core cloud usage.

This bundling advantage erodes Akamai’s historical edge in enterprise supply chain depth.

Open-Source Revolution: Democratizing CDN with De joueurs That Challenge the Status Quo

Beneath the hyperscaler gloss, a quiet revolution is unfolding through open-source CDN projects—tools that empower developers and ISVs to bypass vendor pricing tiers and customize delivery logic transparently. Services like Terminus, delivered via Kubernetes, offer a self-hosted, API-first approach, enabling organizations to automate caching, enforce security policies, and integrate CDNs into DevOps pipelines without waiting for vendor roadmaps.Terminus has gained traction among developers seeking granular control and packet-level visibility, particularly in multi-cloud and hybrid environments. Alongside emerging players like Cloudflare Workers (despite being a CDN-as-a-service rather than self-managed), these open-source alternatives present compelling cost and configurability trade-offs. Akamai’s closed, enterprise-centric platforms must now contend with the growing preference for open, extensible, and cost-efficient solutions.

Specialized Edge Providers: Redefining Speed, Security, and Intelligence

Beyond generic delivery and scale, a new breed of competitors focuses on niche capabilities—performance at the edge with low-latency compute, security hardening against DDoS and bot traffic, and intelligent routing powered by real-time network analytics. Platforms like Fastly, tried-and-true among media and gaming publishers, now compete directly with Akamai by embedding edge logic via programmable pipelines and in-depth customization. Fastly’s edge computing platform allows dynamic content manipulation—such as A/B testing or real-time personalization—at the edge, reducing round-trip latency and enhancing user experience.Meanwhile, closed-rate players like Ooyala and StackPath target vertical-specific demands: video encoding, bot management, and identity-driven content delivery—areas where Akamai’s once-universal stack requires add-ons rather than native optimization. Akamai’s breadth remains unmatched, but these specialists deliver targeted innovation that resonates with verticals demanding performance beyond default CDN features. Their ability to integrate security, analytics, and edge computing into cohesive edge platforms challenges Akamai’s all-in-one promise.

Customer Expectations: The New Battleground for Trust and Control

The shift in competitive dynamics reflects deeper changes in buyer priorities. Modern digital customers no longer settle for a “one-size-fits-all” CDN. They demand transparent pricing, granular control over content policies, and seamless compatibility with CI/CD workflows.Security has become non-negotiable—with DDoS resilience, bot detection, and zero-trust models critical to existing and new infrastructure. Akamai’s strength lies in its massive footprint and enterprise-grade SLAs, but competitors exploit friction points: opaque billing, slow deployment cycles, and rigid SLAs. Organizations now test not just latency and uptime—but how easily they can update caching rules, integrate security, or scale globally.

Open-source and cloud-native tools align with these expectations, offering the real-time flexibility Akamai’s legacy architecture struggles to match without costly modernization. This customer-driven shift has accelerated demand for hybrid, composable CDN strategies—where Akamai coexists with specialized edge services rather than dominating outright. The future market rewards providers who blend established reliability with modular, developer-friendly innovation.

The Future of Delivery: A Pluralistic, Agile CDN Landscape

Akamai remains a CDN giant, but the once-clear hierarchy is fracturing. Cloud hyperscalers like AWS and Azure dominate scale and integration, open-source projects disrupt cost and control, and niche edge platforms outperform in specialization. These competitors do not merely challenge Akamai—they redefine the contours of content delivery.The next generation of CDNs will likely blend Akamai’s global infrastructure with the agility of Kubernetes-based, open-source solutions—empowering enterprises to build responsive, secure, and cost-efficient networks tailored to unpredictable digital demands. As customer expectations evolve toward runtime adaptability and full-stack visibility, the CDN battlefield becomes less about who holds the most data centers, and more about who delivers the smartest, fastest, most secure edge experience.

Related Post

Unraveling The Compassionate Journey: Robert Hight’s Wife Illness and the Resilience of Love

Lindsey Nance: WSMV Star’s Journey—Age, Height, and Marriage Behind the Fame

Is Brittney Griner Transgender? Decoding Gender Identity in the Age of Public Scrutiny

Streamline Your Ohio License: Mastering State BVE Online Services