Why You’re Dumbsick and Broke—and How to Transform Your Mind, Money, and Future

Why You’re Dumbsick and Broke—and How to Transform Your Mind, Money, and Future

In a world where success is often equated with financial wealth and intellectual sharpness, many feel trapped in a cycle of financial stress and mental fatigue—dumbed down not by lack of effort, but by a deep disconnection from the knowledge and habits that drive lasting prosperity. The mindset of being “dumsick” — mentally sluggish, overwhelmed, and mentally drained—rarely stems from laziness, but from systemic gaps in financial literacy, poor decision-making patterns, and emotional barriers that block growth. Yet, clarity is possible.

This journey isn’t just about accumulating money—it’s about rebuilding intellect, discipline, and confidence to break free from scarcity and build abundance. The transformation starts with understanding: why you’re stuck, and how to learn, think, and act smartly to become wealthy and mentally resilient.

Being dumsick is more than just financial instability—it’s a mental state fueled by confusion, overload, and a lack of know-how.

Research by behavioral economists shows that financial stress impairs cognitive function, reducing working memory and decision quality by up to 40% when stress hormones like cortisol remain elevated. This mental fog traps people in reactive spending, avoidance, and short-term thinking, perpetuating a cycle where financial struggles breed more confusion and fear. Psychologists note this as “cognitive fatigue,” where sustained stress wears down the brain’s executive function, making complex planning feel impossible.

Breaking free requires not just financial knowledge, but a reset of mental habits and emotional resilience.

Step 1: Diagnose the Root Causes—Why You’re Broke and Stuck The first hurdle to overcoming financial and cognitive struggles is honest self-assessment. Many blame luck, bad markets, or systemic inequality without examining personal behavior and mindset. Key culprits include: - **Chronic Financial Illiteracy:** Lack of basic knowledge about budgeting, compound interest, debt, and investing leaves people uninformed gamblers rather than strategic players.

As financial educator Suze Orman often says, “You can’t control the market, but you can control your habits.” - **Emotional Spending & Avoidance:** Pseudo-intelligence—pride in sounding knowledgeable—often masks emotional spending, fear of loss, or avoidance of complex decisions. “People confuse knowledge with wisdom,” notes author and investor Tim Ferriss, “and wisdom emerges when data meets behavior.” - **Overextension Without Direction:** Juggling multiple income streams without clear goals or systems leads to burnout. Studies show multitasking drains mental energy and increases errors by 50%.

- **Lack of Long-Term Vision:** Focusing solely on immediate needs silences planning for the future. Without a vision, money becomes a constant chase, not a tool for empowerment. Identifying these triggers is the essential first step toward transforming mindset and behavior.

Step 2: Build Financial Literacy—The Anti-Dumbness Toolkit Once ignorance is acknowledged, structured learning is the key to reclaiming control. Financial literacy replaces fear with confidence—transforming “I’m dumsick” into “I understand.” Core pillars include: - **Foundational Concepts:** Understand cash flow, net worth, inflation, risk tolerance, and asset allocation. These basics form a mental framework for every financial decision.

- **Practical Skills:** Master budgeting with tools like zero-based budgeting or the 50/30/20 rule; track net worth monthly; learn to read financial statements and understand credit scores. - **Investment Knowledge:** Move beyond fast tips to long-term strategies such as index fund investing, dollar-cost averaging, and diversification. Education demystifies markets and reduces panic during downturns.

- **Smart Debt Using:** Recognize when debt helps (e.g., low-interest mortgages, strategic business loans) and when it harms (high-interest credit cards, lifestyle inflation). Numerous personal finance experts, including CLSA’s John Paul Wright, emphasize that “financial literacy isn’t just a skill—it’s a survival tool in today’s economy.” Without it, even ample income offers little security.

Step 3: Cultivate Mental Resilience and Smart Habits Wealth and wisdom coexist only in environments where discipline replaces impulse and long-term thinking overrides short-term gratification.

Building mental strength requires intentional strategies: - **Mindset Reset:** Adopt a growth mindset—see challenges as learning opportunities, not failures. Psychologist Carol Dweck’s research shows that viewing effort as a path to mastery fosters persistence. - **Goal Visualization:** Define clear, specific financial targets—emergency fund, debt payoff, retirement—and use them as constant motivators.

“Vision without action is futile, but vision with action is unstoppable,” objets leadership coach John Maxwell. - **Habit Stacking:** Integrate micro-habits like daily budget reviews, weekly financial planning, and 15-minute learning sessions to build consistency without overwhelm. - **Emotional Detachment:** Separate money from ego and moral judgment.

Wealth management is systematic, not sentimental—replaces fear-driven spending with evidence-based choices. These habits transform daily choices, turning scattered effort into compounding success.

Step 4: Leverage Education and Community for Accelerated Growth No one becomes financially intelligent in isolation.

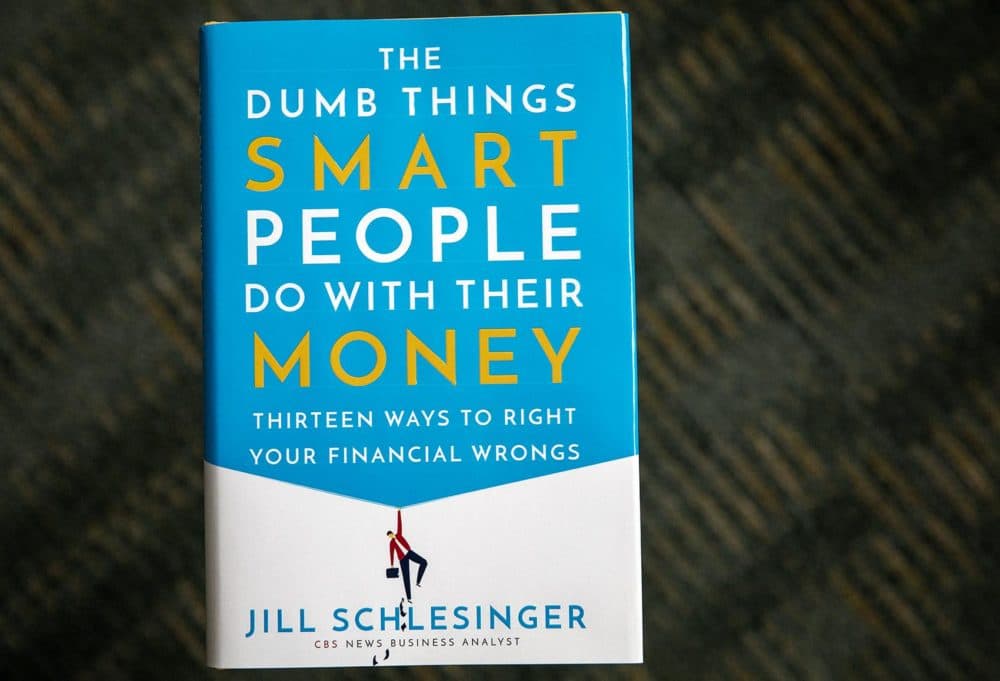

Strategic use of knowledge-sharing and community resources accelerates ownership of wealth-building mindset. - **Formal Education:** Enroll in accredited finance courses, read foundational books (e.g., *Rich Dad Poor Dad*, *The Simple Path to Wealth*), and govern self-study with trusted platforms like Coursera or Khan Academy. - **Mentorship & Peer Learning:** Seek mentors who model financial discipline and join

Related Post

18+ Movierulz: Your Ultimate Guide to Streaming Adult Content Safely and Legally

How Much Does Jason Momoa Weigh? The Physical Power Behind Hollywood’s Once_Most_Tagged A-Physical

Unlock Endless Creativity with Cool Minecraft Banner Patterns: Your Complete Guide

Fani Willis 2024 Salary Sparkles: What Will the Star Among Professional Athletes Actually Report?