Winden Business Debit: The Engine Driving Modern Corporate Spending Efficiency

Winden Business Debit: The Engine Driving Modern Corporate Spending Efficiency

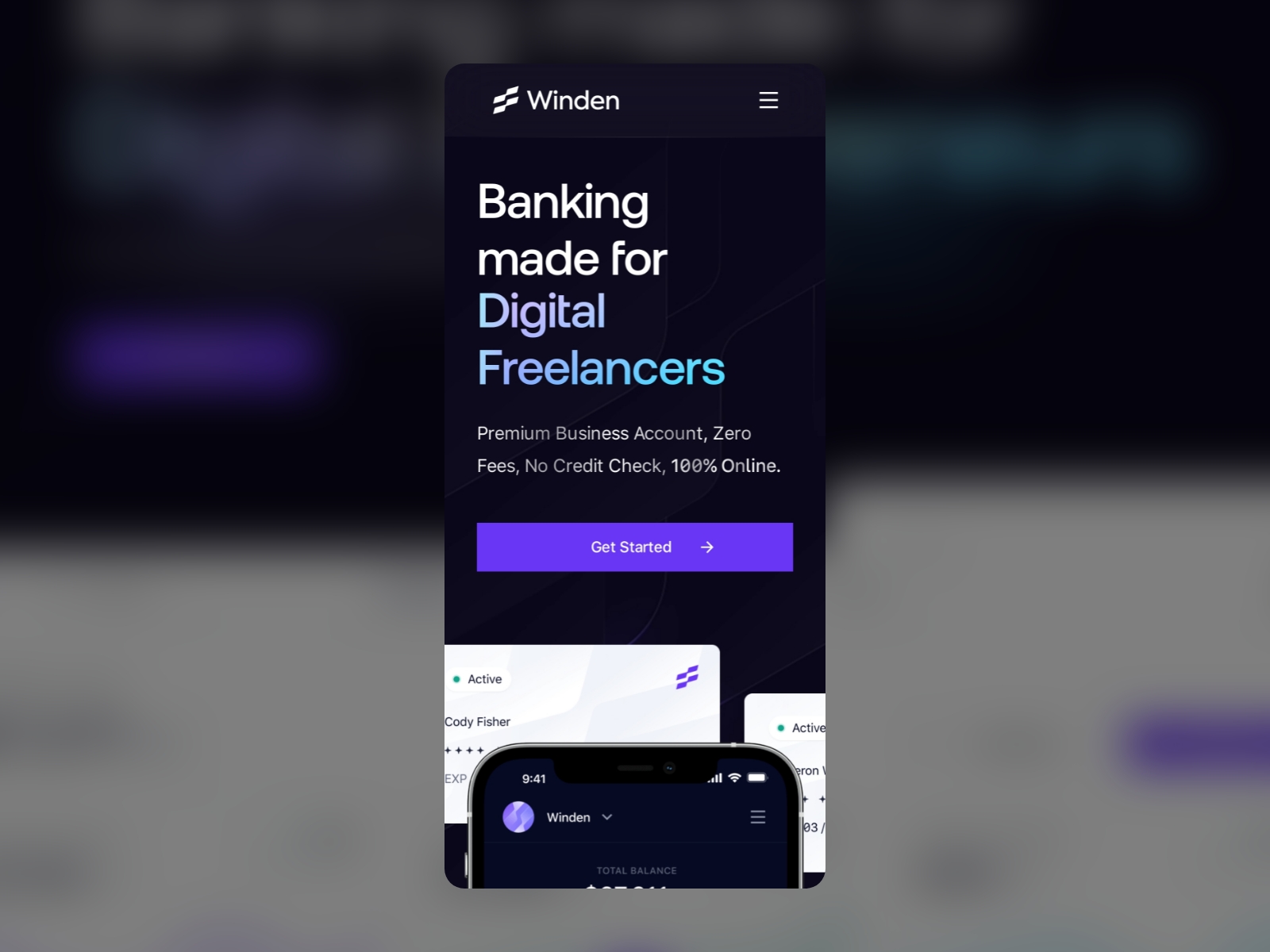

In an era where operational precision meets financial control, Winden Business Debit has emerged as a transformative tool for organizations navigating the complexities of expense management. This dedicated corporate debit solution streamlines financial workflows, enhances transparency, and empowers businesses with real-time insights—redefining how enterprises handle everyday procurement and payment processes.

At its core, Winden Business Debit is engineered for businesses of all sizes seeking a reliable, integrated payment and spending platform.

Unlike traditional corporate card systems burdened by fragmented interfaces and delayed reconciliation, Winden unifies transaction processing, budget monitoring, and compliance analytics into a single, intuitive dashboard. “What sets Winden apart,” explains finance director Elena Rostova of a mid-sized manufacturing firm, “is its ability to turn scattered expense data into actionable financial intelligence—without sacrificing speed or security.” < portions of technology and functionality >

The Architecture Behind Winden’s Operational Advantage

Winden Business Debit operates on a cloud-native infrastructure built for scalability and resilience. Its multi-layered design combines: - **Secure transaction routing** that encrypts every payment in real time, ensuring PCI compliance across all business units.- **Dynamic budget allocation tools**, allowing managers to set and adjust spending limits per team, department, or project—supporting both autonomy and financial oversight. - **Automated reconciliation engines** that match purchases against purchase orders, contracts, and delivery receipts, drastically reducing manual accounting work and human error. The platform integrates seamlessly with accounting software, ERP systems, and procurement tools—creating a unified workflow from purchase requisition to vendor settlement.

This connectivity is crucial: according to a 2023 report by Gartner, 78% of finance teams cite system integration as a top priority for reducing operational friction. < success stories and real-world impact > Businesses across industries are experiencing measurable gains since adopting Winden Debit. A leading regional logistics provider, for example, reduced month-end close time by 40% after deploying the platform.

“The automated approval workflows and spending visibility let us catch overspending early—saving over $650,000 annually in unplanned charges,” noted operations manager Carlos Méndez. Similarly, a healthcare distribution company leveraged Winden’s analytics dashboard to align procurement with clinical demand, cutting redundant buys by 22% while improving supplier negotiation power. Quantifiable results like these underscore Winden’s shift from mere card issuance to strategic financial enablement.

< key features shaping financial discipline > Several defining features distinguish Winden Business Debit as a modern expense management standard: - **Micro-Spend Analytics**: Real-time spend breakdowns by category, location, and team, enabling proactive adjustments. - **Multi-Factor Authentication (MFA)**: Enhanced security protocols protect sensitive financial data and prevent unauthorized access. - **Mobile-First Interface**: Field staff and remote teams can approve purchases, track balances, and submit receipts on the go—ensuring accountability never takes a backseat.

- **Custom Reporting & Alerts**: Tailorable reports and configurable spending thresholds trigger instant notifications when budgets are approached, preventing overspending before it escalates. These capabilities not only reduce risk but actively foster a culture of fiscal responsibility. A 2024 survey by Deloitte found that organizations using sophisticated expense platforms like Winden report 35% higher compliance rates and faster audit preparation.

< challenges overcome and future-proof design > In managing corporate expenditures, organizations face persistent pain points: delayed approvals, opaque spending patterns, and inconsistent enforcement of company policies. Winden Business Debit directly addresses these by embedding governance into daily operations. “Rather than reacting to financial anomalies,” says compliance officer Anil Patel, “Winden’s proactive design preempts issues—like duplicate payments or unauthorized vendors—before they impact the bottom line.” As remote work and digital transformation accelerate, adaptability is paramount.

Winden’s cloud-based architecture ensures seamless scalability, from startup hustle to enterprise full scale. The platform’s AI-driven anomaly detection continuously learns from transaction patterns, improving fraud prevention over time. This evolutionary capability positions Winden not just as a debit tool, but as a long-term financial partner in an unpredictable business landscape.

< the broader implications for corporate finance > Winden Business Debit exemplifies a broader shift in how businesses manage capital and accountability. By placing spending

Related Post

Winden Business Debit Settlement: Master Business Transactions with Confidence

College World Series Today: Watch Games, Track the Schedule, and Test Your Bet With Precision

Daily Bulldog Farmington’s Simple Trick Transformed a Maine Search and Rescue Dog Visit into a Lifesaving Library Moment

Buying A Used Car In Finland: Your Essential Guide to Smart Purchases