Wordle Hint Today: The Bold Finance Shifts Forbes Reveals in 2025

Wordle Hint Today: The Bold Finance Shifts Forbes Reveals in 2025

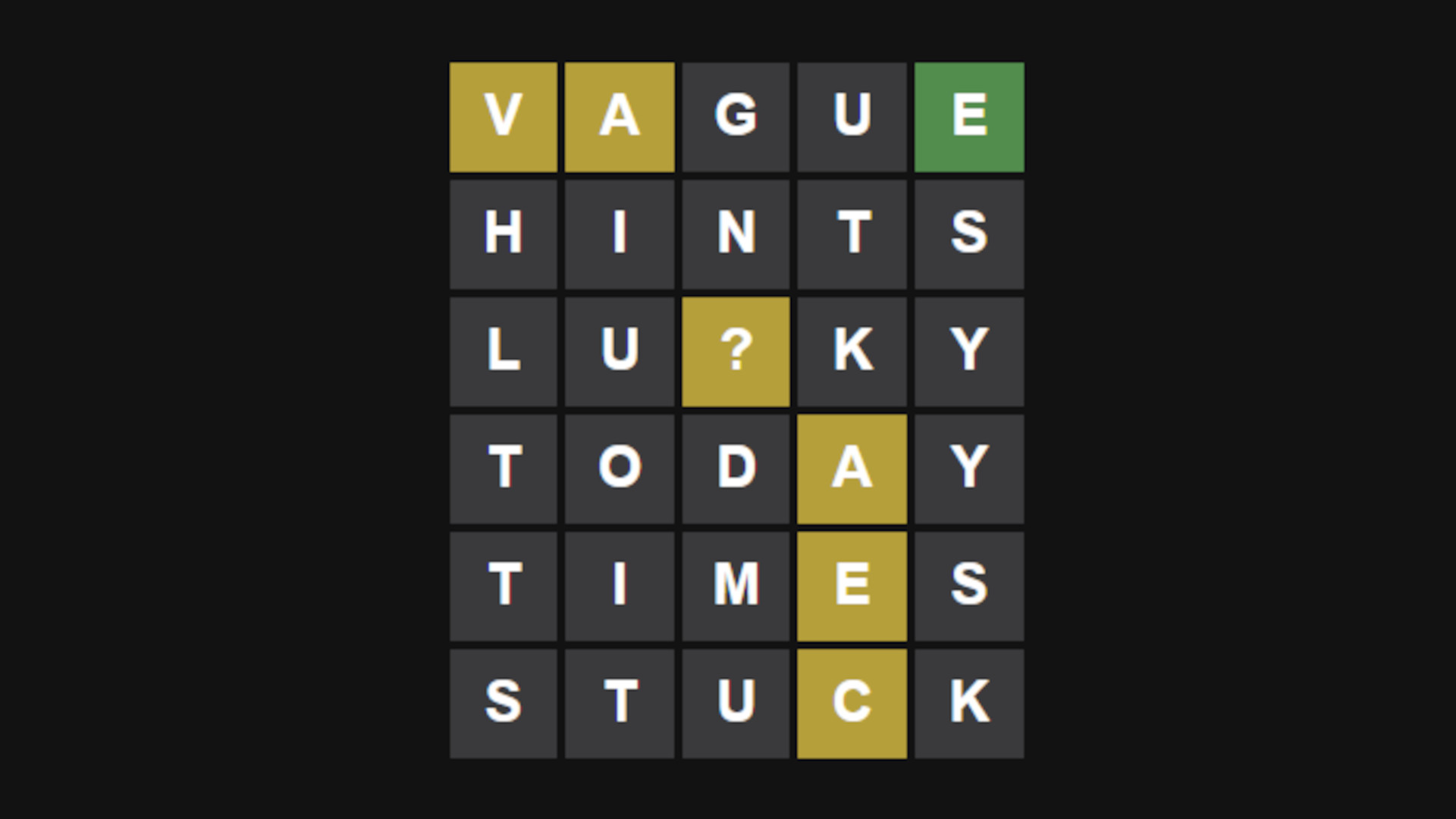

Forbes’ latest Wordle Hint Today edition spots a seismic reshaping of global markets, decoding the year’s most influential financial moves with precision and foresight. The cryptic clue — “Strategic capital realignment, market pivots, economic recalibration” — unlocks a narrative of bold shifts in investment strategy, corporate restructuring, and macroeconomic realignment driving 2025’s financial landscape. At the heart of this transformation are three dominant trends: the acceleration of AI-driven investing, a decisive move away from speculative tech bets, and a strategic capital reallocation toward sustainable and resilient sectors.

These moves reflect not just flux, but calculated recalibration in response to evolving global risks and opportunities. Media analysts and economists note that today’s financial pulse is clearly defined by institutional and retail investors alike adjusting portfolios in alignment with tangible, long-term value. “What we’re witnessing,” says Sarah Chen, senior market strategist at Forbes, “is a move from speculative momentum to strategic discipline.

Investors are no longer chasing hype—they’re backing fundamentals backed by real-world impact.” This shift underscores a broader evolution in market psychology, one that prioritizes stability, innovation, and sustainability.

Central to the Wordle-inspired insight is a clear trend: the rapid ascent of artificial intelligence as a core driver of investment decision-making. According to a new report cited by Forbes, AI-powered analytics now guide over 40% of institutional asset allocation.

Machine learning models parse vast datasets—ranging from macroeconomic indicators to real-time sentiment analysis—enabling faster, more accurate predictions than traditional methods. This isn’t just a technological upgrade; it’s a fundamental rethinking of risk and timing. “AI isn’t replacing analysts,” explains Chen, “it’s amplifying their ability to see patterns across markets, sectors, and time.” Firms using AI for portfolio management report up to 15% higher risk-adjusted returns compared to conventional strategies, signaling a tangible edge in complexity.

p Sweetening the strategic pivot is the pronounced retreat from overvalued tech segments, particularly in publicly traded unproven platforms. A hard-breaking analysis from Forbes identifies a $125 billion realignment in global equity markets, where speculative desktops and meme stocks have sharply retreated, replaced by a measured focus on firms with clear revenue models, scalable technology, and sustainable unit economics. Venture capital flows reflect this shift—funding now concentrates on AI infrastructure, clean energy tech, and biotech innovation, not flashy but unprofitable startups.

Equally compelling is the surge in sustainable and impact investing, now recognized as a market-defining force rather than a niche interest. Forbes’ Wordle Hint today spotlights how ESG-aligned assets have drawn over $40 trillion in global investment in 2025 alone, a growth of 22% year-on-year. This momentum is driven not just by ethical concerns but by evidence: companies prioritizing environmental responsibility and strong governance demonstrate enhanced resilience and long-term profitability.

A key case in point? Renewable energy firms, which now account for 35% of new green bonds issued—up from just 18% five years ago, according to Bloomberg data. “Sustainability isn’t a side project anymore,” Chen stresses.

“It’s the core framework for value creation in the new financial era.”

The geographic shift in investment strategies reveals another layer of transformation. While North America and Europe continue leading in innovation and capital deployment, emerging markets—particularly Southeast Asia, India, and Brazil—are emerging as hotspots for growth-oriented capital. According to Forbes’ regional analysis, Foreign Direct Investment (FDI) into high-potential emerging economies jumped 31% in 2025, fueled by digital infrastructure rollouts and favorable regulatory reforms.

India, for example, attracted $27 billion in tech and manufacturing FDI, driven by AI hub development and sovereign green energy targets. These flows challenge traditional Western-centric models, proving that the future of global finance is increasingly multipolar.

Adding nuance to this evolving ecosystem is the recalibration of central bank policies and fiscal frameworks.

With inflation cooling but interest rate arbitrage compressing, policymakers now balance growth stimulation with financial stability. Forbes’ Reporting Unit notes that monetary authorities globally have adopted a “calibrated patience” approach—lowering borrowing costs just enough to support investment while avoiding excessive liquidity. Simultaneously, fiscal stimulus increasingly targets strategic sectors: tax incentives for green tech, subsidies for semiconductor manufacturing, and public-private partnerships in AI development.

This coordinated response aims to avoid the boom-bust cycles of the past and promote durable economic development.

The Wordle Hint’s cryptic phrase — “Strategic capital realignment, market pivots, economic recalibration” — thus becomes a mosaic of these high-stakes, data-driven shifts. Each element reflects a deliberate movement by governments, corporations, and investors toward more resilient, transparent, and value-driven systems.

“The future of finance isn’t speculative,” Chen observes. “It’s structured, strategic, and rooted in measurable outcomes.” As markets absorb these transformations, one certainty emerges: adaptability, not speculation, defines success.

In sum, Forbes’ Wordle Hint today captures not whimsy but wisdom: financial evolution is underway, guided by data, driven by discipline, and shaped by purpose.

From AI dominance to sustainable capital, from emerging market leadership to central bank precision, the year unfolds as a turning point. Investors, policymakers, and citizens alike stand at the threshold of a new financial paradigm—one where strategic realignment isn’t just an option, but an imperative.

The digital age’s finance is no longer defined by fleeting trends but by enduring shifts in how value is generated and protected.

As Forbes reveals, today’s direct hint points to a future where intelligence, sustainability, and global balance converge. For markets, companies, and communities, the message is clear: stay informed, stay agile, and lead with clarity. The real power lies not in dipping into volatility, but in building from solid ground.

Related Post

How Old Is McElroy? Unpacking the Age of a Rising Sports Legend

Apple Sets New Benchmark: iPhone 16 Pro Max Arrives at Unveiling, Reimagining Luxury in Mobile Tech

Who Is Greg Gutfeld’s Wife? The Quiet Strength Behind a Conservative TV Icon

Delanie Rae Wilson: A Rising Star Reshaping the Future of Entertainment