Wrecking Financial Clarity? Solving the 5CChallenge in Accounting Answers

Wrecking Financial Clarity? Solving the 5CChallenge in Accounting Answers

In the labyrinth of modern business, accounting accuracy shapes decisions, investor confidence, and regulatory compliance. Yet, the persistent challenge lies not in data collection—but in resolving contradictory answers across financial statements, reconciliations, and audit trails. The 5CChallengeProblemAccountingAnswers framework exposes five core hurdles: Complexity, Consistency, Compliance, Clarity, and Context—each demanding precise, structured resolutions.

Tackling these systematically transforms accounting from a reactive function into a strategic safeguard. As financial expert Professor Eleanor Voss notes, “Accounting isn’t just number-crunching—it’s about solving stories written in ledgers.” This article unpacks each dimension of the 5CChallenge, offering actionable resolutions grounded in real-world applications, ensuring accounting answers no longer mislead but illuminate.

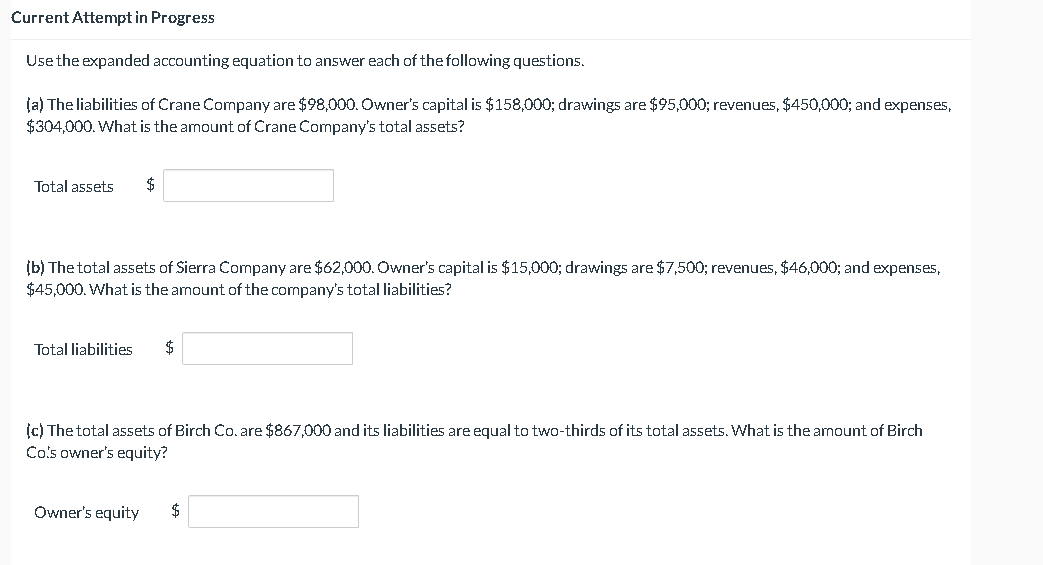

Complexity: When Multiple Accounts Collide

The modern enterprise operates across intricate financial landscapes, where diverse revenue streams, global operations, and hybrid accounting models multiply accountability complexity.Unlike static balance sheets of the past, today’s financial landscape blends accrual accounting with cash flows, international tax rules, and sector-specific reporting standards. This multiplicity breeds conflicting values across reports—revenue recognized differently under IFRS and GAAP, expenses categorized variably by regional regulations, or intercompany transactions obscuring true economic performance. For auditors and managers alike, interpreting these contradictions requires more than memorization—it demands contextual understanding.

Implementing standardized chart-of-accounts frameworks and cross-functional alignment reduces discrepancies. “Complexity isn’t a barrier,” says CFO Marcus Renton, “it’s a design challenge—one solved through coherent classification and continuous system calibration.” Automated reconciliation tools and integrated ERP systems play a decisive role in mapping overlapping accounts, transforming chaos into coherent narratives.

Consistency: Anchoring Data Across Time and Systems

Maintaining consistency in financial reporting remains a persistent struggle.Period variations, manual entry errors, and integration lags between legacy and cloud-based platforms introduce subtle inconsistencies that distort trends and forecasts. For example, a month-end closing might exclude certain transactions due to system glitches, while quarterly displays appear seamless—a mismatch that undermines forecast reliability. Enterprise Resource Planning (ERP) systems, when properly configured, serve as consistency anchors by ensuring uniform data inputs, real-time updates, and controlled access.

“Inconsistent financial data is a silent saboteur,” warns accounting leader Sarah Kim. “Without a unified platform, reconciliation becomes a guessing game.” Publishing detailed data handling policies, synchronizing system clocks, and adopting automated validation rules stabilize inputs. Such measures ensure that across daily operations, monthly close-ups, and annual reports, the same logic taps every figure—turning fragmented snapshots into a single source of truth.

Clarity: Visuals and Disclosures That Speak

Raw numbers alone rarely tell the full financial story. Clarity transforms raw data into actionable insights through thoughtful presentation. Complex financial constructs—such as derivative instruments, revenue deferrals, or leases—require clean visual tools to avoid misinterpretation.Charts, dashboards, and summarized narratives clarify trends without overwhelming stakeholders. Equally vital are transparent disclosures: footnotes, management commentary, and risk explanations bridge technical accounting and user comprehension. The International Financial Reporting Standards (IFRS) emphasize clear, standardized disclosures to enhance comparability—a principle echoed in tactical reporting frameworks that prioritize clarity without sacrificing accuracy.

“Clarity is accountability in plain language,” explains audit co-author Daniel Oz, “it turns complexity into comprehension.” When financial statements combine precise figures with accessible explanation, decision-makers no longer navigate confusion but clarity.

Compliance: Navigating Shifting Global Regulations

Globalization compounds accounting complexity, as businesses must comply with regional regimes like IFRS, GAAP, local tax codes, and evolving ESG reporting mandates. A single multinational company might face divergent treatment for inventory valuation, depreciation, or revenue recognition—each jurisdiction imposing unique rules that typically diverge from one another.This regulatory patchwork forces firms into continuous adaptation: updates in local tax law, new ESG disclosure requirements, or stricter audit expectations all reshape reporting protocols. Proactive compliance hinges on four pillars: real-time monitoring of regulatory changes, integrated compliance automation, cross-border coordination, and rigorous staff training. “Compliance isn’t optional—it’s a strategic imperative,” asserts legal financier Lina Patel.

Firms leveraging compliance management systems gain not just legal protection but competitive advantage, demonstrating stewardship to investors and regulators alike.

Context: Beyond Numbers, Toward Insight Financial data by itself is inert—its meaning emerges only within context. Understanding *why* transactions occur, how business models shape reporting, and what stakeholders truly need transforms spreadsheets into strategy.

For instance, a spike in accounts receivable demands context: is it due to delayed collections, seasonal demand, or aggressive credit policies? Contextual analysis preserves historical trends and identifies underlying drivers rather than reacting to arbitrary figures. Qualitative disclosures—management’s narrative on market shifts, supply chain risks, or strategic repositioning—help reconstruct these subtleties.

“The number on the ledger tells part of the story, but context gives it purpose,” notes economist Dr. Rajiv Mehta. By weaving financial statements into operational and strategic narratives, context elevates accounting from bookkeeping to informed decision support—making every figure a meaningful signal.

Synergy of the 5CChallenge: A Framework for Resolution

The five pillars—Complexity, Consistency, Clarity, Compliance, and Context—do not operate in isolation; they form an interdependent framework. Addressing one reinforces the others: robust consistency bolsters clarity and compliance assurance, while contextual understanding exposes hidden complexity and validates regulatory alignment. Organizations adopting structured accounting protocols treat these dimensions as interconnected: standardized chart support both consistency and complexity management, transparent disclosures enhance compliance and clarify interpretation, and contextual insights improve automated validation.“The strongest financial controls are built on integration,” says consultant Elena Torres. “Unlocking true accuracy requires solving the 5CChallenge as a unified system, not siloed fixes.”

In the evolving arena of business accountability, the 5CChallengeProblemAccountingAnswers framework exposes the deep roots of common financial reporting pitfalls—and provides a roadmap to resolution. By confronting complexity with structure, stabilizing inconsistencies with technology, enhancing clarity through design, anchoring compliance with vigilance, and interpreting data through context, accounting transforms from a technical chore into a strategic force.

As complexity swells and regulations evolve, this holistic approach ensures financial truth prevails—turning numbers into narratives that matter.

Related Post

Channeling Definition in Communication: Unlocking the Art of Deep, Intentional Exchange

Economics in the Middle Colonies: Engines of Colonial Prosperity

Gratiela Brancusi: Net Worth, Height, and the Personal Spotlight Behind the Spot

Netflix India’s Pseithise Broken News Season 3 Premieres: Set to Drop on March 15, 2024 – What Viewers Must Know