Unlock Instant Cash with SBI Gold Loan: Your Fast, Secure Financial Rescue

Unlock Instant Cash with SBI Gold Loan: Your Fast, Secure Financial Rescue

In today’s fast-paced financial landscape, emergencies don’t wait—and neither should your ability to act. The SBI Gold Loan, offered through one of India’s most trusted banking institutions, delivers immediate liquidity with minimal hassle, blending speed, transparency, and reliability. Leveraging SBI’s robust infrastructure, the loan lets borrowers access funds secured by precious gold, offering a smart alternative to conventional borrowing when every minute counts.

The gold loan facility from State Bank of India (SBI) stands out for its simplicity, speed, and security. Unlike traditional loans burdened with paperwork and lengthy approvals, SBI’s Gold Loan allows urgent borrowers to access funds within hours—sometimes even as quickly as the same day—by pledging gold as collateral. This swift turnaround meets the real-world urgency of financial needs such as medical emergencies, urgent repairs, or sudden income gaps.

Key to the appeal is SBI’s digital-first approach.

Borrowers can initiate the process through mobile banking apps or dedicated internet portals—no need to visit a branch. Eligibility hinges on a valid gold asset that meets SBI’s appraisal guidelines, with approved values capped at a percentage of the gold’s valuated market price, typically around 50–70% of the liquidated gold worth. “We’ve streamlined the workflow to ensure speed without compromising on due diligence,” explains a senior SBI financial services executive.

“Our tech-driven appraisal, automated risk assessment, and direct disbursement eliminate delays and reduce stress.”

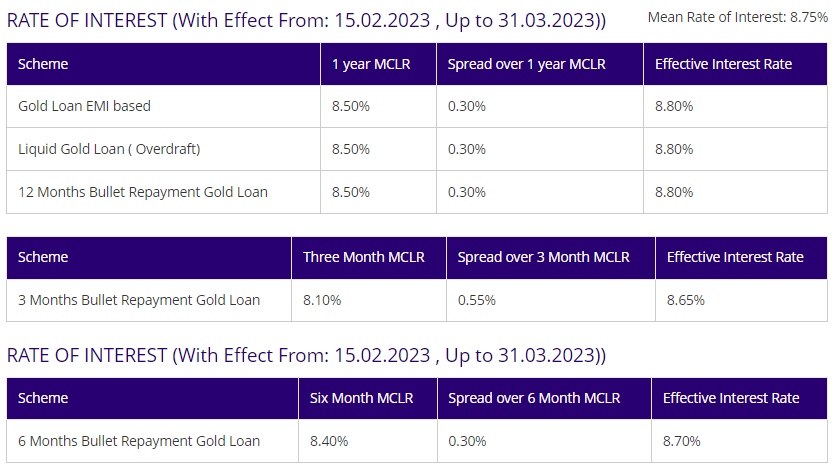

Why Gold Loan from SBI Stands Above the Rest

- **Secure, Streamlined Access to Funds** Unlike high-interest payday loans or opaque informal credit sources, SBI’s gold loan offers secure financing backed by tangible collateral. The bank’s appraisal process is rigorous and transparent, minimizing the risk of unfair valuations. - **Flexible Repayment Structures** Borrowers choose outlays tailored to their income rhythm—from daily installments to monthly repayments spanning up to 24 months—ensuring affordability amid unpredictable cash flows.- **Rapid Disbursal via Digital Channels** With SBI’s integrated online platform, funds flow directly into the borrower’s account within 24 to 48 hours after document verification, reducing waiting times to near zero. - **Competitive Interest Rates and Transparent Terms** SBI offers one of the most favorable pricing in the gold loan space, with fixed rates starting as low as 11–13% per annum for eligible applicants. Full disclosure of charges, including prepayment penalties and turnaround timelines, fosters trust.

- **24/7 Support and Real-Time Tracking** Borrowers track their application status in real time via SMS or app notifications. Customer support is available around the clock, easing questions and ensuring peace of mind throughout the journey.

Key Eligibility and Application Steps – Who Can Benefit?

To qualify for an SBI Gold Loan, applicants must: - Hold at least 50 grams of pure gold (22 and 28 carat) as physical gold, preferably stored in secure自宅 safe or trusted deposit.- Own valid proof of identity (Aadhaar, PAN, bank account) and address (utility bill, rental agreement). - Have a stable income stream, typically verified through salary slips, self-reported income, or business records. - Meet the bank’s creditworthiness criteria, including a robust financial profile with no unresolved legal or financial disputes.

The application begins via SBI’s mobile app or website. Borrowers upload digital copies of ID, address proof, and gold documents—including a recent appraisal certificate from a licensed valuator. Once submitted, the loan amount is assessed within minutes, and funds are transferred via net banking or depositing into the linked account within 24–48 hours.

Prepayment is allowed without penalties, offering borrowers flexibility if future funds become available.

Loan Limit, Tenure, and Repayment: Real-World Numbers

SBI’s gold loan scheme balances generous access with financial prudence: - Loan Amount: Up to ₹5 lakh (varies based on gold purity and appraised value), with some regional branches permitting up to ₹5.5 lakh. - Tenure: Flexible repayment spans 6 months to 24 months—long enough to align with income cycles without stretching borrowers’ finances.- Monthly Installment: Ranges from ₹5,000 to ₹20,000, depending on the loan amount and tenure chosen, calculated using a transparent EMI model that reflects the gold’s secured value. - Interest Only After Prepayment: Borrowers pay interest only once the principal is repaid over time; if early repayment occurs, no prepayment charges apply, further protecting their liquidity.

This structure reflects SBI’s focus on fair, long-term financial support.

As one Mumbai-based small business owner recently noted: “When my son’s treatment hit, I needed cash in a day—SBI’s gold loan stepped in without weeks of paperwork. Disbursal was quick, rates fair, and tracking clear. This is banking done right.”

Balancing Security, Speed, and Responsibility

The SBI Gold Loan exemplifies a broader trend in Indian banking—leveraging tangible assets to deliver responsible credit.By

Related Post

Water Crisis Under Pressure: Analyzing South Africa’s Social and Political Response to the 2019 WS2 Paper 2 Challenge

NoahLalonde Revolutionizes Digital Innovation with Groundbreaking AI-Driven Solutions

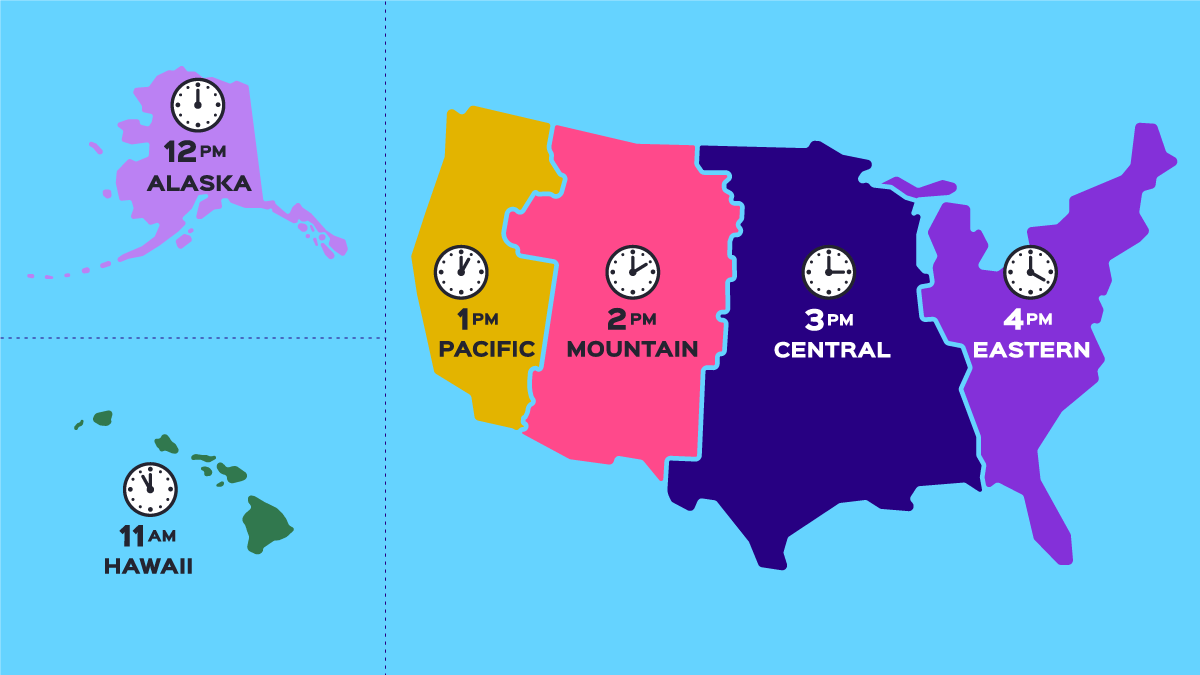

Why Arizona Stands Apart: Observing Mountain Standard Time While Time Now Now Evolves

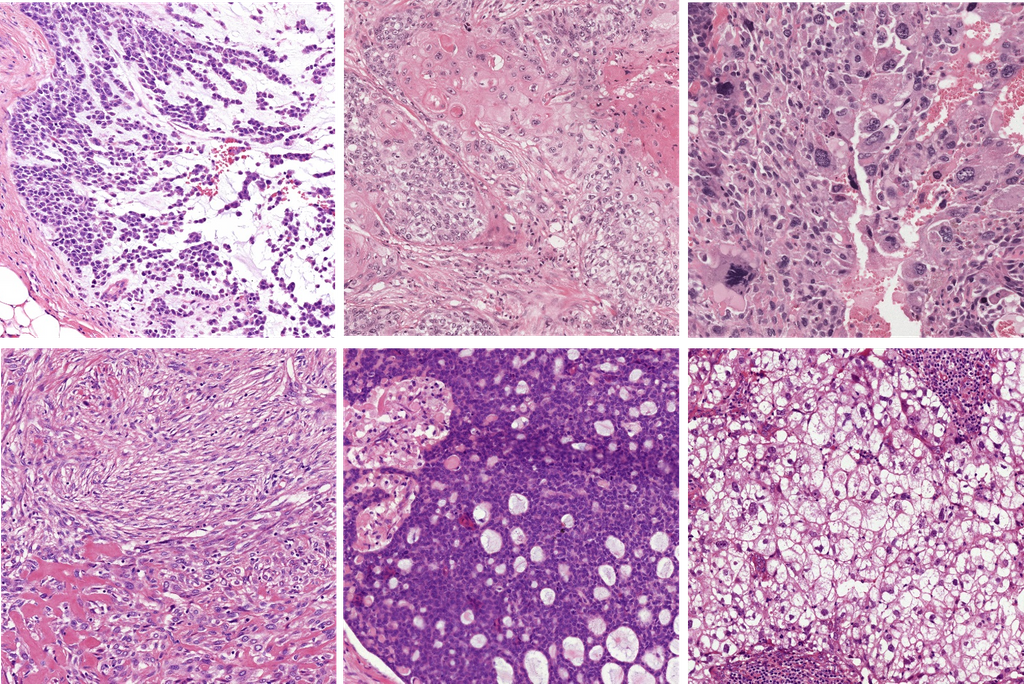

After 10 Years: The Hidden Reality of TNBC Recurrence and What It Means for Survivors